The Asia Pacific Exchange (APEX) in Singapore is China's first international exchange to go abroad and establish itself independently. It was established with the approval of the Monetary Authority of Singapore and is the third exchange established in Singapore. It is a major breakthrough for Chinese companies to "go global" in the 40 years of reform and opening up.

The business scope of the Singapore Asia Pacific Exchange covers commodities and financial derivatives, including futures and options trading of agricultural products, energy, metals, exchange rates, interest rates, stock indices, bonds, etc.

In February 2018, the Asia Pacific Exchange of Singapore was officially awarded an exchange license and a clearing house license by the Monetary Authority of Singapore.

After two to three months of simulation exercises and customer preparation, the Asia Pacific Exchange plans to officially open for business in May 2018, with refined palm oil futures as the first product to be launched. In the future, the Asia Pacific Exchange will focus on the industrial characteristics and development needs of the Asia Pacific region and build a complete product line of commodities and financial derivatives in five years.

The trading network of the Asia Pacific Exchange covers the world, and its trading and clearing members will include mainstream futures brokers in Singapore, Hong Kong, China, Europe and the United States. The trading rules are formulated in accordance with international standards to meet the trading habits of global investors. The Asia Pacific Exchange has an independent clearing house (APEX Clear) and has established a central counterparty guarantee system in accordance with international standards.

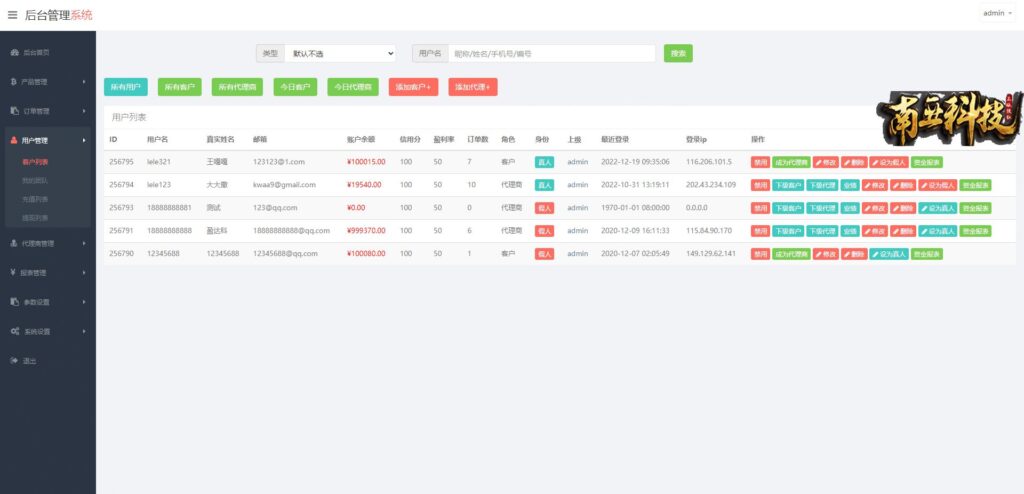

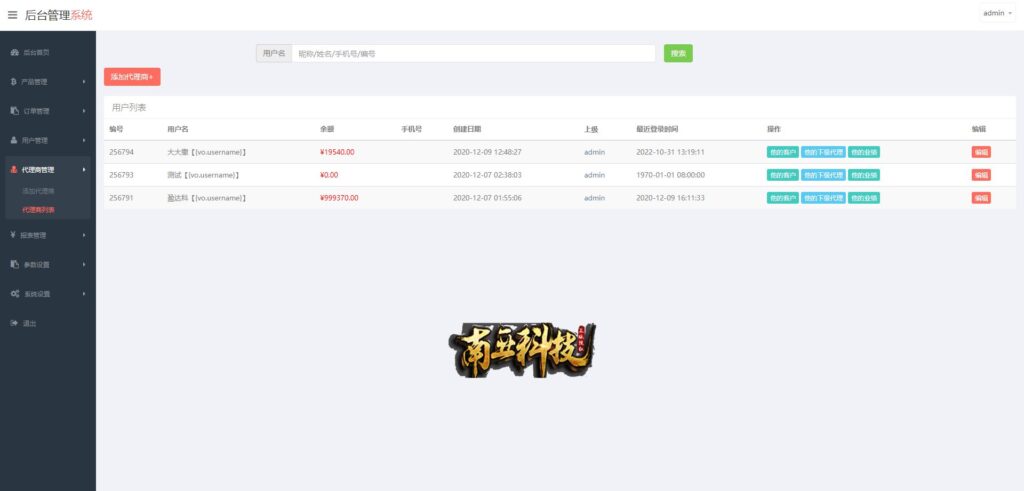

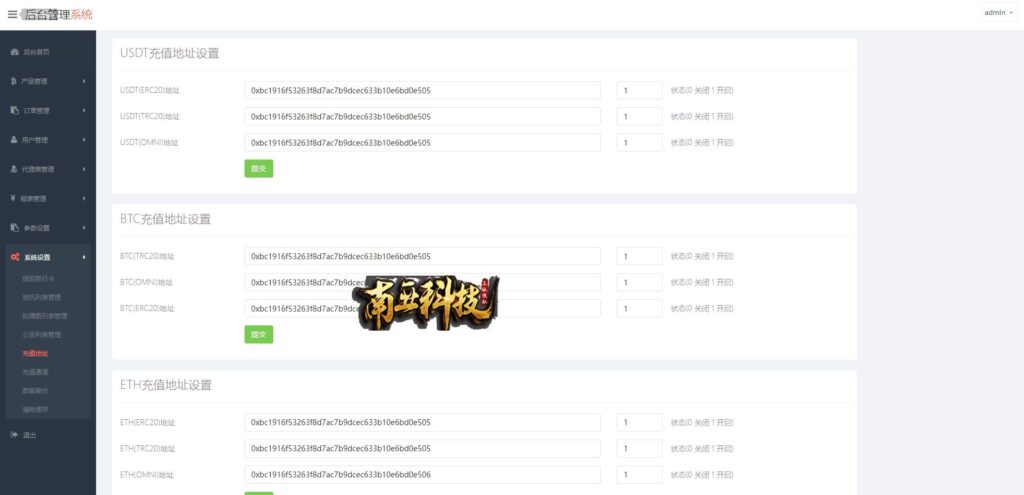

The system is a second-generation front-end UI plus multiple languages, and the framework is still the same as before.

The default K line interface is Alibaba's. If you need to change it to another one, you can contact Nanya, otherwise the K line cannot be moved.