Japanese stock exchange source codeThe Group was established in January 2013Tokyo Stock Exchange和Osaka Stock ExchangeIn order to enable all market players to conduct securities transactions at any time with confidence, the Group and all its subsidiaries and related companies have been committed to the establishment and operation of financial product markets.

About Japanese stock securities source code

Specifically, we provide market facilities for trading of stocks and other securities and derivatives, publicize market conditions, ensure the fairness of transactions, and provide a platform for businesses such as debt underwriting of securities.

The Group is committed to providing all market players with a full range of integrated services from the listing, trading, clearing, settlement to information release of securities, thereby establishing a safer and more convenient trading venue.

In addition, since October 2019, the Tokyo Commodity Exchange has become a subsidiary of our group, and we have also begun business such as the establishment and operation of a new commodity futures trading market.

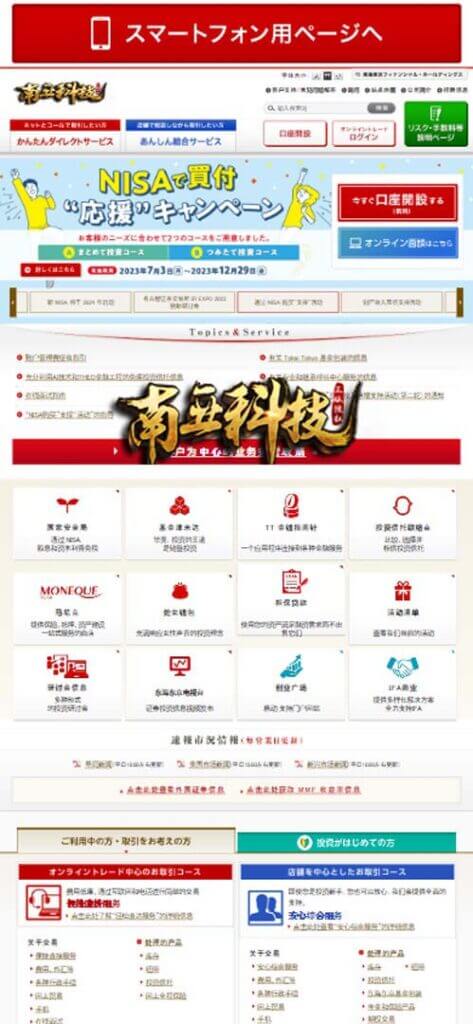

Tokyo Stock Exchange

Tokyo Stock Exchange(hereinafter referred to as "East Exchange”) is a financial commodity exchange that has obtained a financial commodity market operation license in accordance with the provisions of the Financial Commodity Exchange Law. Specific businesses include: providing market facilities for securities trading, publishing market conditions, ensuring the fairness of securities trading, and other financial commodity market businesses conducted by other related exchanges.

The core of the East Exchange

The markets include Prime, Standard and Growth. The total market capitalization of listed companies and the turnover of stock transactions in these markets are ranked third among global exchanges and first in Asia, establishing the central position of the Japanese securities market.

In addition, in recent years, the Group has been actively working on the diversification of listed products from the perspective of meeting the diverse needs of investors, and has continuously expanded the lineup of ETFs and ETNs that can diversify investments in a variety of products with small amounts and low costs. In addition to domestic stock price indices, the TSE also provides investors with a variety of products as a one-stop market, such as foreign stock indices; commodities such as precious metals and agricultural products; products linked to REIT indices; and products linked to leveraged indices and inverse indices that amplify and reverse the rise and fall of the original index.

In order to make transactions go smoothly and maintain market stability and reliability, stable system operation is a prerequisite. In addition, in order to enrich and deepen transaction methods through the development of financial technology, respond to the launch of new products in a reasonable and flexible manner, and continuously meet the needs of market users, it is necessary to continuously build and improve IT infrastructure.

The East Exchange uses "arrowhead" as the trading system for the spot market, which is characterized by high speed, reliability and scalability. Arrowhead has the high speed of short order response time and fast information release, and the reliability of triple storage protection for order, transaction, trading disk and other trading information. It can be said to be the highest specification trading system in the world. In order to further enhance market competitiveness, the East Exchange plans to upgrade arrowhead in 2015.

The financial derivatives market established by OSE is a comprehensive exchange that can realize one-stop trading as a comprehensive exchange in financial fields such as stock index trading and commodity fields such as precious metal trading. Stock index futures trading targets domestic and foreign indices, among which Nikkei average stock price futures trading, Nikkei 225mini, Nikkei average stock price options trading and TOPIX futures trading are representative derivatives in Japan. In addition, long-term government bond futures trading in government bond futures trading has become an indicator of the long-term interest rate market due to its high liquidity. In addition, the gold market is the largest in East Asia, the platinum market has the highest liquidity in the world, and the rubber market price is becoming a global indicator.

The financial derivatives market established in TOCOM can trade energy derivatives such as crude oil futures and electricity futures. TOCOM's Dubai crude oil price has become the de facto benchmark for crude oil prices in Asia and the Middle East.

OSE and TOCOM will further enhance the competitiveness of the derivatives market from the perspective of improving investor convenience by introducing new products and redefining trading systems. In addition, in terms of trading hours, in addition to daytime trading hours, night trading is also available.

The stable operation of the trading system is a basic requirement to ensure smooth trading and maintain market stability and reliability. In addition, with the development of financial technology, trading methods have become more diverse and complex, and new products are constantly launched. In order to flexibly respond to the above situation and meet the needs of market users, we must continue to develop IT infrastructure. OSE and TOCOM use the "J-GATE" system with the highest performance in the world as the trading system for the derivatives market.