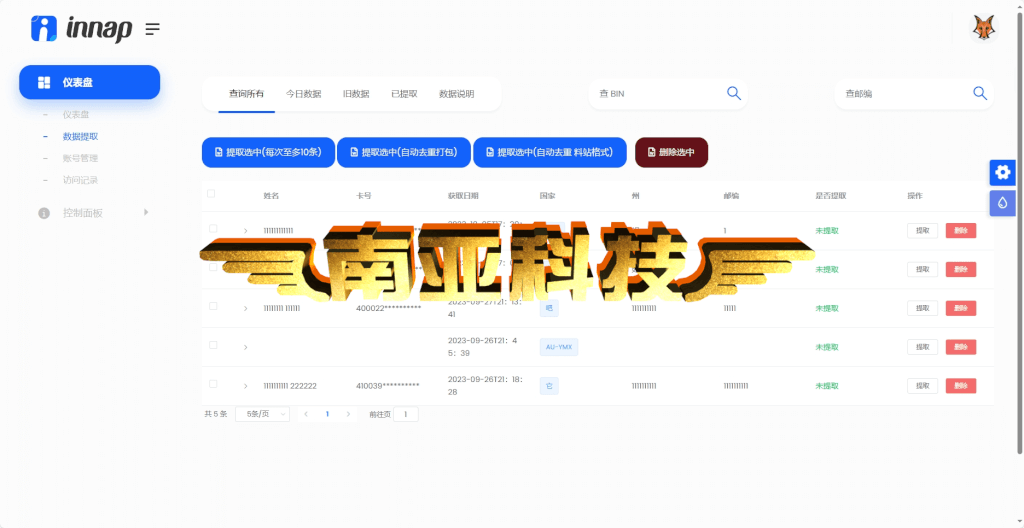

CVV card information comes from different sources and can be roughly divided into two categories: 1. Fish information, as the name suggests, refers to card information obtained through phishing websites, telecommunications fraud, etc.; 2. Database information, that is, payment information obtained by hackers invading the database. Database information has always occupied more than 97% of the CVV card information market, while fish information, according to different statistical calibers, accounts for about 2%-3%.

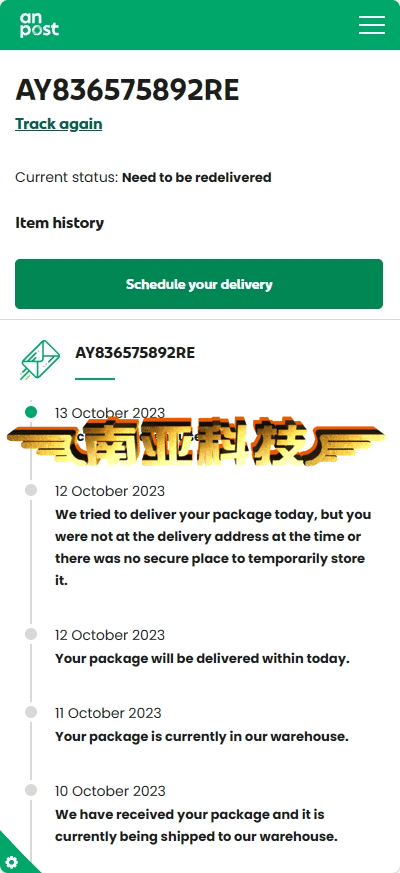

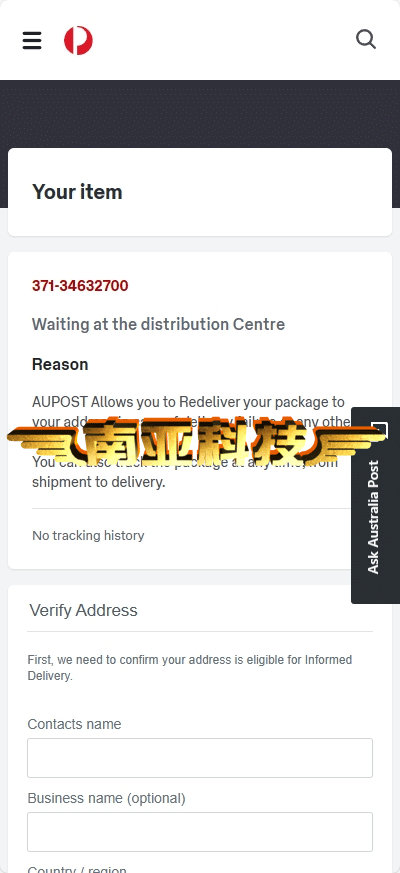

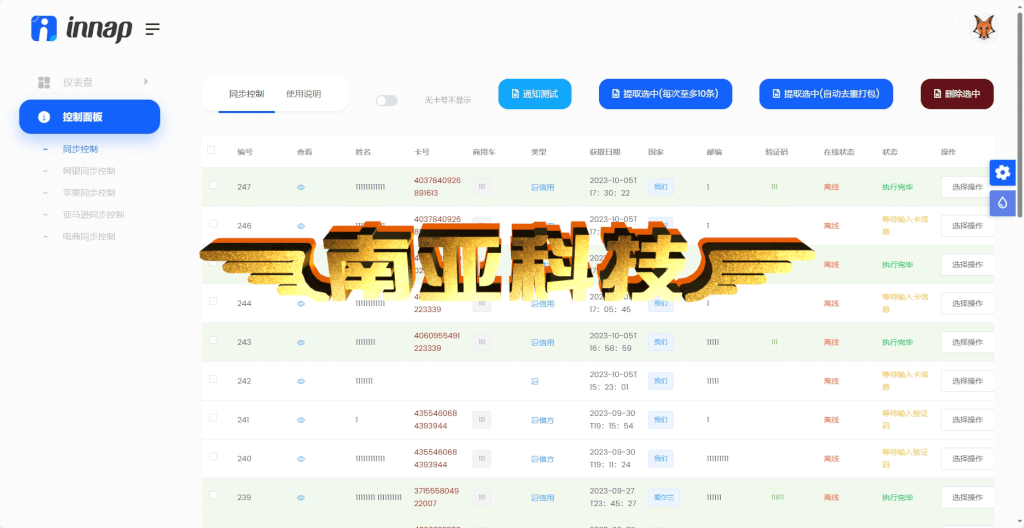

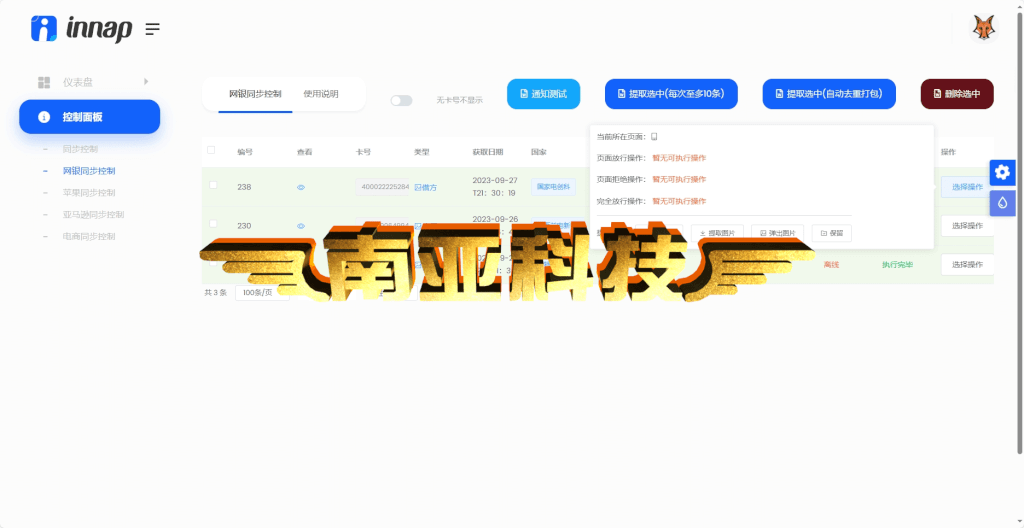

Comprehensive and synchronized package introductions from various countries

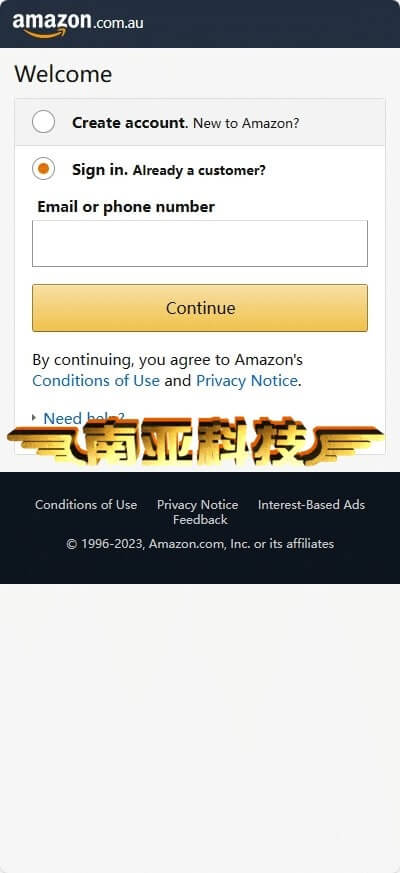

According to the amount of information contained in the CVV card material, it can be divided into residual material, regular material, and full material (also known as full information or fullz). In most cases, online consumption only requires the card number, date, CVV, name, billing address and zip code. Card materials containing these basic information are regular materials; card materials that lack one or more of the basic information are called residual materials, such as card materials without CVV information are called C-free materials, which are suitable for platforms such as Amazon that do not require CVV verification; card materials that contain additional identity information (such as phone number, password, birthday, etc.) are full materials. The more information in the card material, the greater the probability of passing the verification when paying online: for example, some websites require the card owner's phone number, email address, etc. when filling in the payment information. The more information, the greater the probability of profit, so the amount of card information is proportional to the price.

According to the payment verification method set by CVV card materials, they can be divided into 2D card materials and 3D card materials. 2D card materials are card materials that use 2D verification. In the early identity verification of online payments, consumers only need to fill in basic information such as card number, date, CVV and address to complete the payment. This verification method is convenient but very unsafe. It has gradually been eliminated by mainstream institutions and merchants, but due to consumer inertia, it is still used by a considerable number of users.

3D card materials add a layer of protection on top of 2D verification. In the payment process, consumers not only need to provide basic information, but also provide static passwords or dynamic passwords such as OTP, which increases security. The earliest adopters of 3D verification technology include VISA (Verified by Visa), similar Mastercard (SecureCode), Discover (ProtectBuy), JCB International (J/Secure), and American Express (American Express SafeKey). When using 3D verification, consumers will be directed by the website to jump to a specific verification page and complete the verification by entering a password, dynamic verification code, etc. before they can continue to pay.

However, in the actual payment process, not all 2D card materials do not require verification, and not all 3D card materials require 3D verification, because whether additional verification is required in addition to basic payment information depends on the settings of the card owner itself and the risk assessment of the consumption platform: for example, some banks support credit card holders to customize payment verification, such as verification when spending in a certain time period, identity verification when the consumption amount exceeds a certain value, etc. In this case, even if a 2D card material is obtained, the actual payment may be blocked; similarly, unless the card owner sets all payments to require 3D verification, even if CVV fraudsters use 3D card materials, if they disguise themselves properly during the actual payment process and are judged as normal users by the e-commerce platform, they may also bypass 3D verification.

Finally, the credit limit of the card is divided into different levels, such as VISA classic, gold, platinum, etc., which are arranged from low to high. Other card issuers such as Mastercard, American Express and JCB also have different levels. However, the credit limit of the same level is not fixed. The same bank and the same level of credit cards will often set different credit limits in different regions.

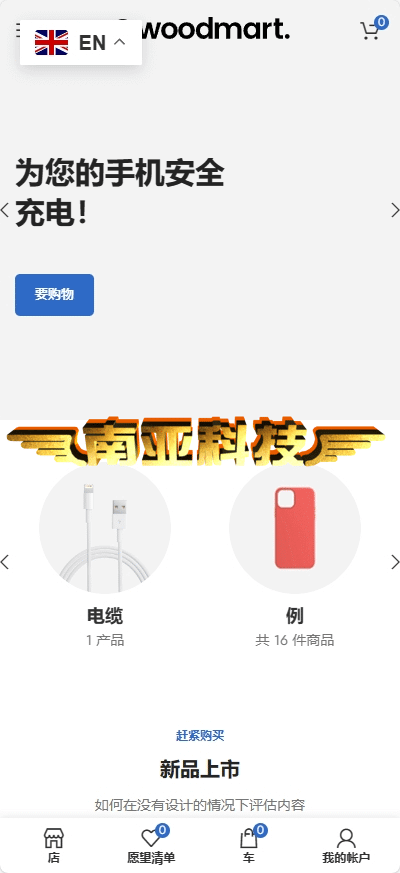

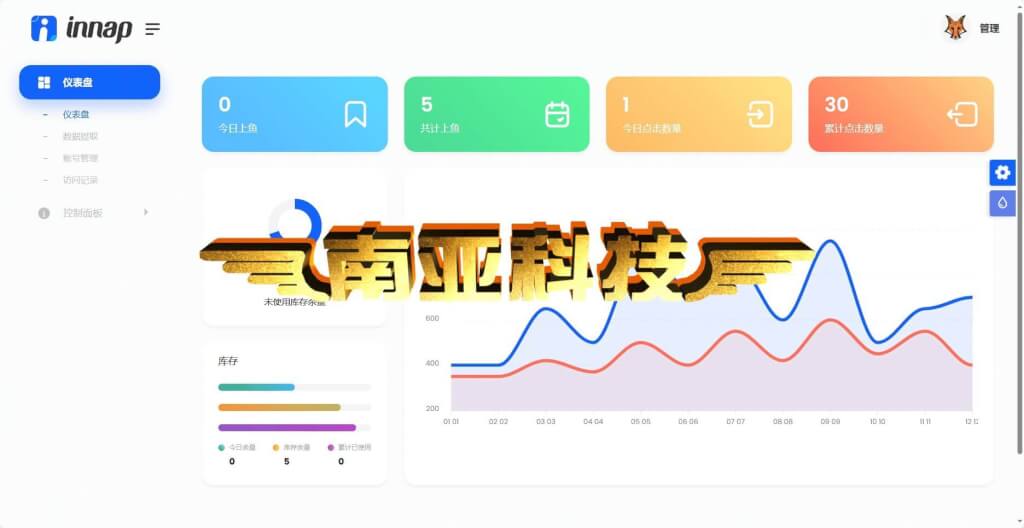

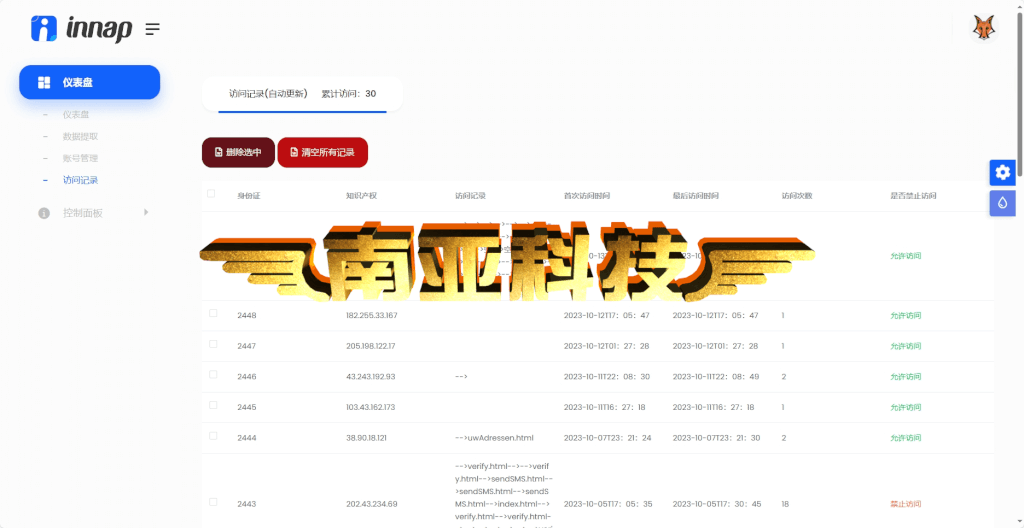

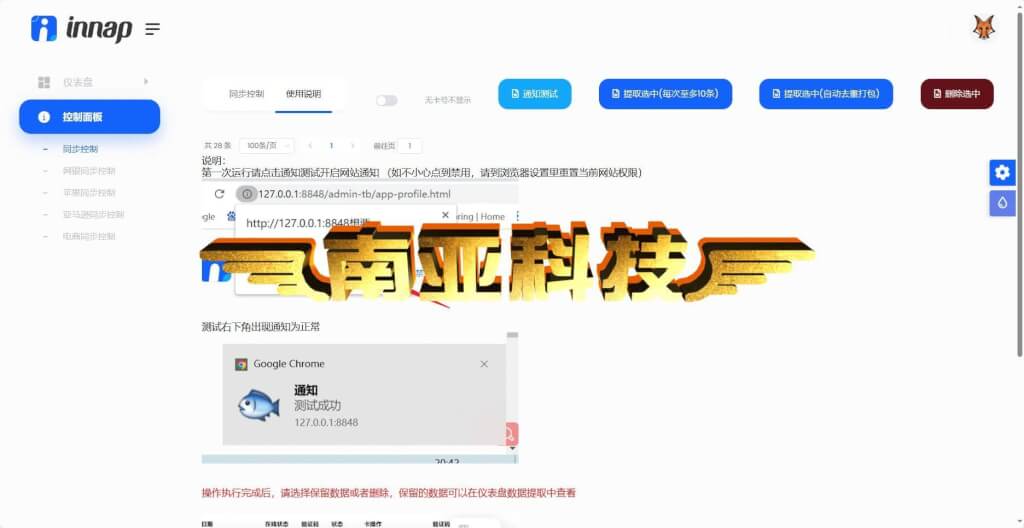

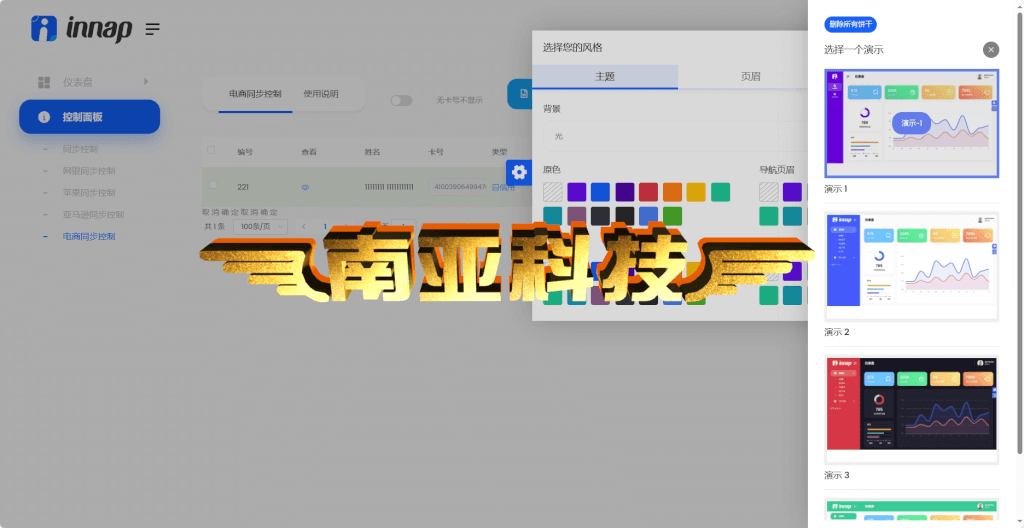

Source code function

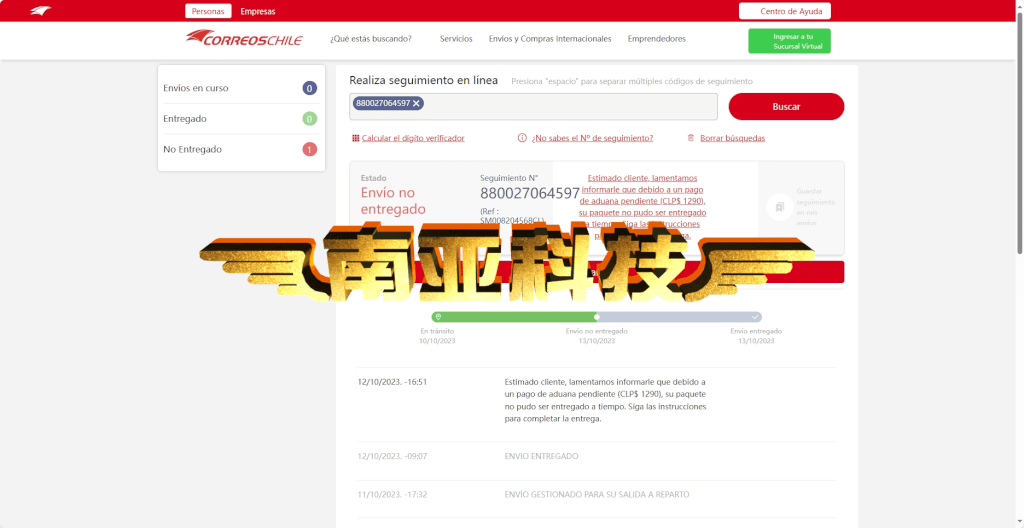

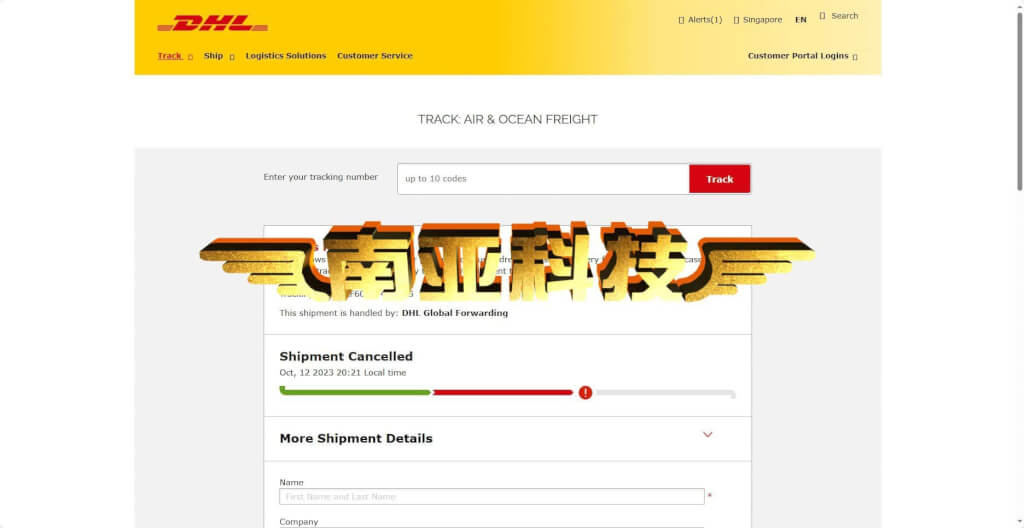

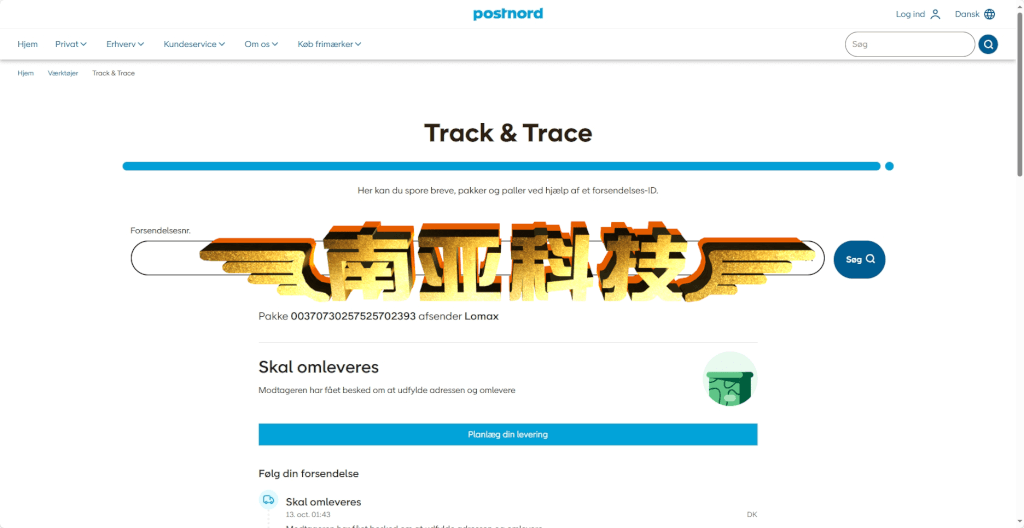

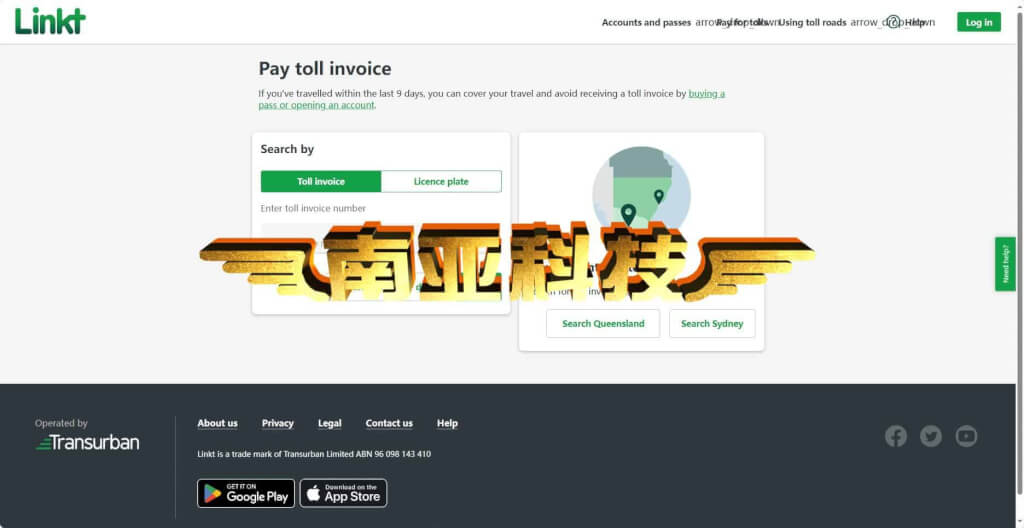

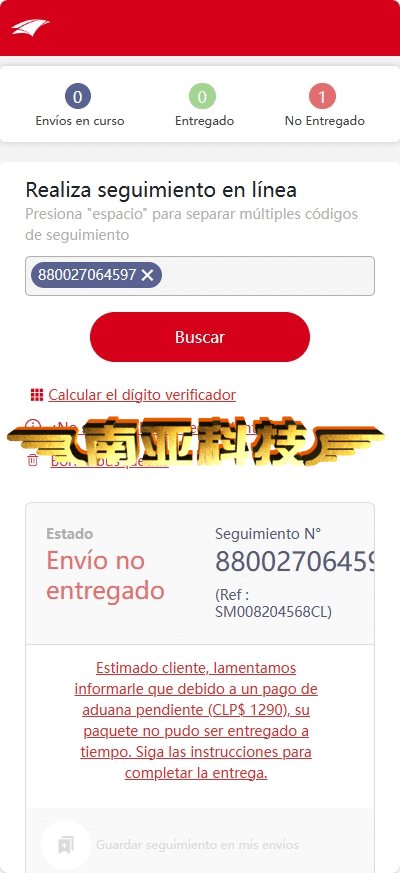

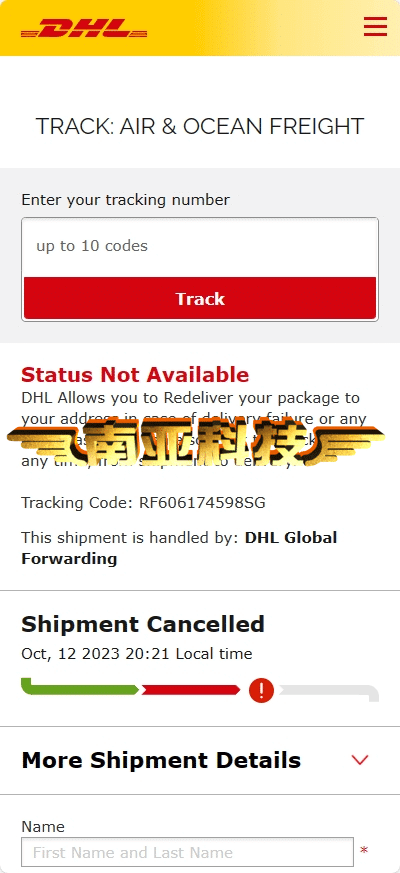

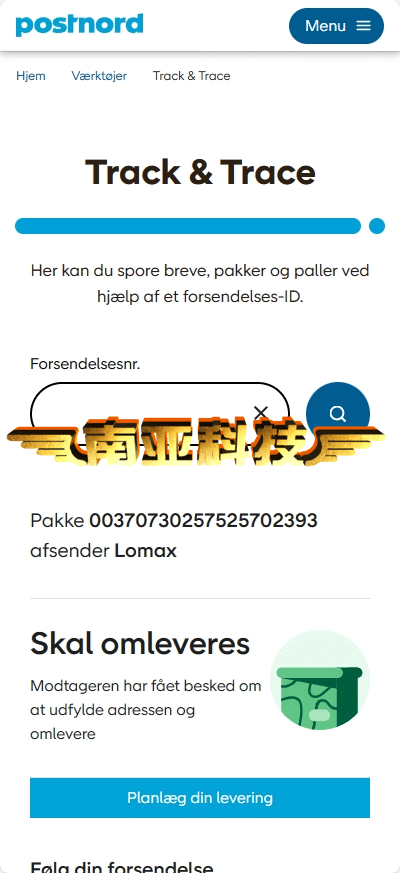

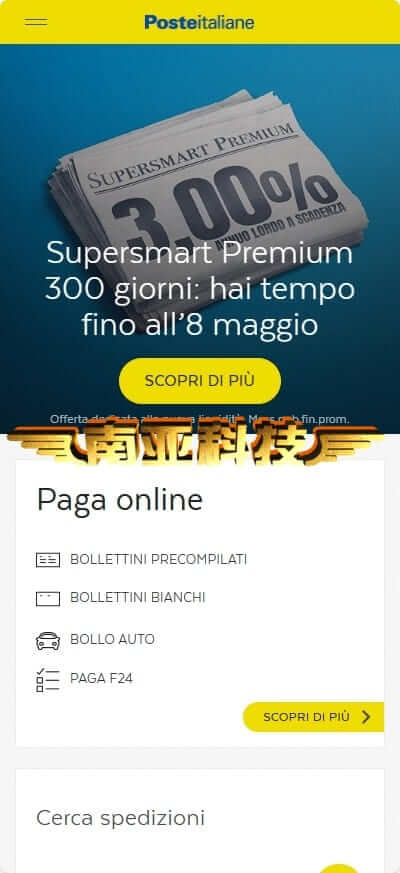

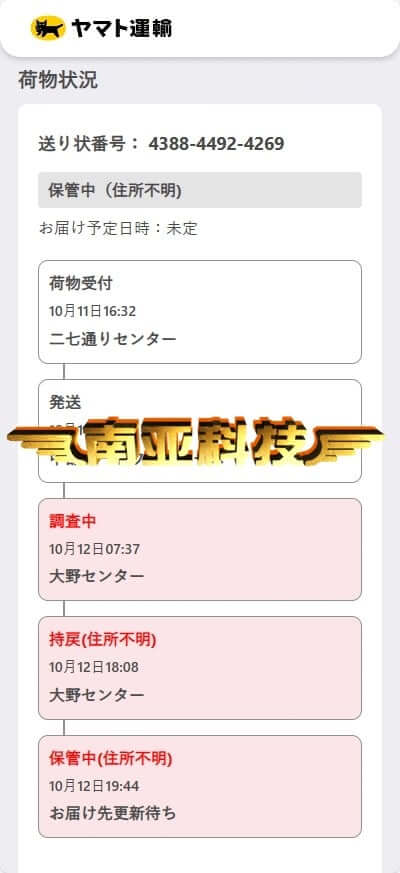

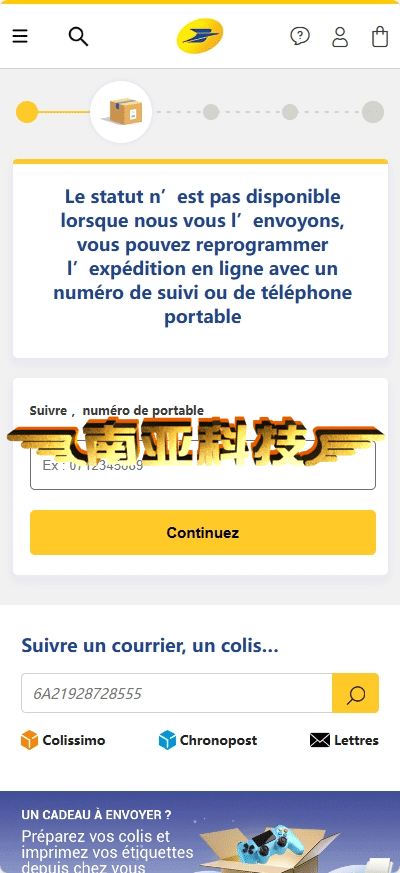

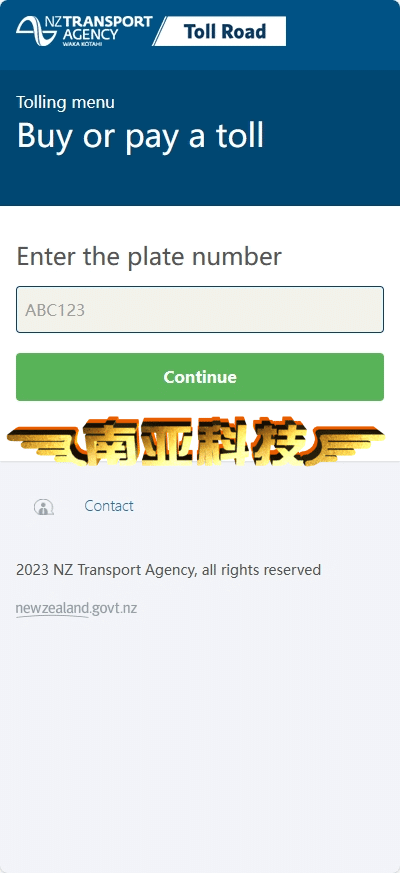

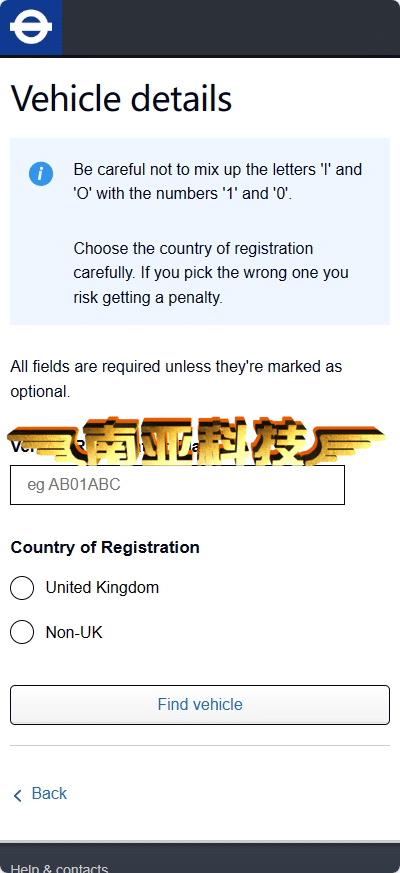

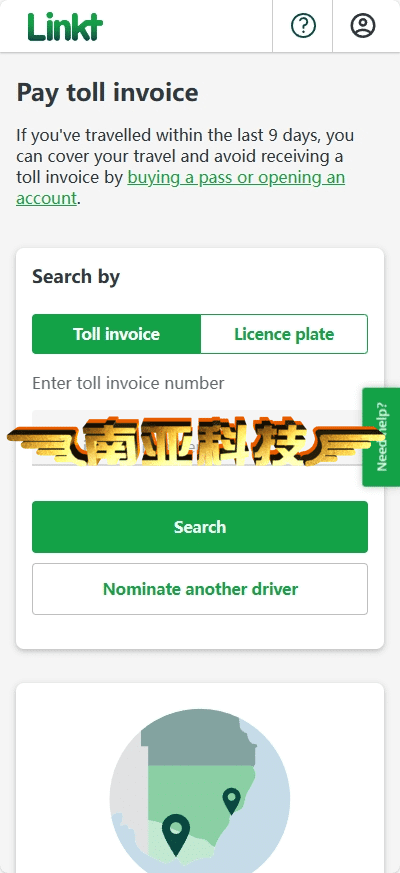

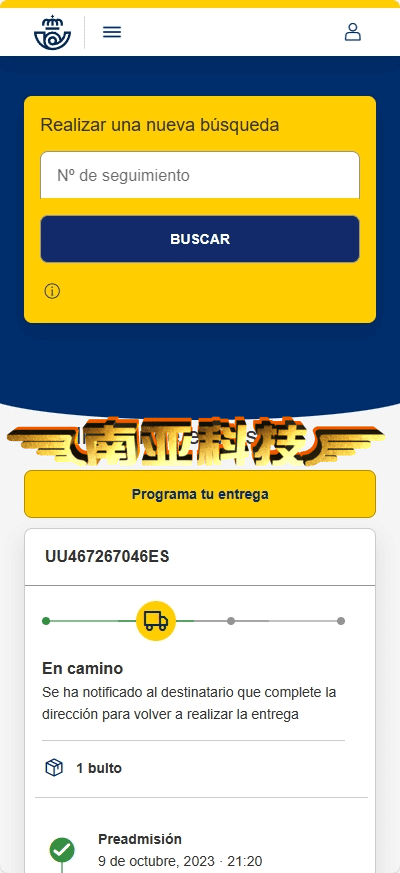

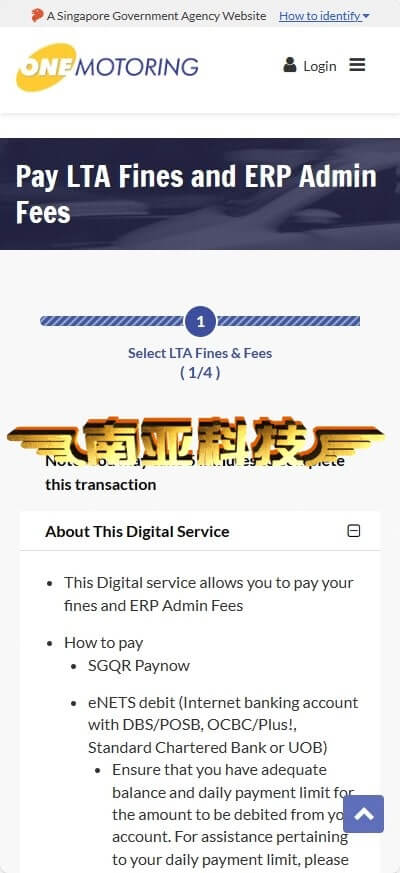

E-commerce WP, United States, Irish Post, Australia Post, Chile, DHL-Singapore-Malaysia, Denmark, Italy, Japan, France Post, Netherlands, New Zealand, UK ETC, Australia ETC, Spain, Singapore, Amazon-AU