Where will the de-CZed Binance go?

AI andWeb3, played one after another to compete for the title.

AI andWeb3, played one after another to compete for the title.

Since the founder of OpenAI staged a real-life palace battle drama that dominated the headlines,BinanceZhao Changpeng (referred to as "CZ") once again took over and became the first person to be reported by global media. Under the heavy exposure, the technology world seems to have vaguely glimpsed the shadow of the times.

Just the day before yesterday,Binanceversus美国The lawsuit came to an end, with 43 billion美元The sky-high fine is the highest in crypto historyfineThe record, in contrast, is the 18-month sentence that CZ may face, and the remaining chapters are the appointment of a new No. 1, increasingly stringent scrutiny, and a seemingly uncertain future for Binance.

Throughout the development history of Binance, under the leadership of CZ, Binance’s platform currency was less than 2017 in 0.5.美元From an unknown player, it has grown to a company that now occupies nearly 60% of the global market share.crypto marketGiant, Binance has given many innovations to the industry.直播The operational gameplay, super customer service, IEO that opened the curtain of the era, and the much-anticipated Binance Chain have woven into the world's most extensive encryption network.

The industry has been buzzing about whether Binance, which has completed de-CZization, can continue its legend under the leadership of its new leader.SupervisionRecent actions have become more confusing.

The Department of Justice intervenes and Binance completes the settlement of the century

On November 11, a piece of news about Binance caused an uproar in the industry. According to Bloomberg,美国The Ministry of Justice is Binance Seeking more than 40 billion美元Offine, as part of a proposed settlement following a years-long investigation into it.

Just as everyone was talking, more details were revealed. In a document made public on Tuesday, Binance was charged with three counts, including money laundering violations, conspiring to operate an unlicensed fund transmission business, and violating美国Sanctions provisions, which include primarily failure to prevent and report suspicious transactions with terrorist organizations.

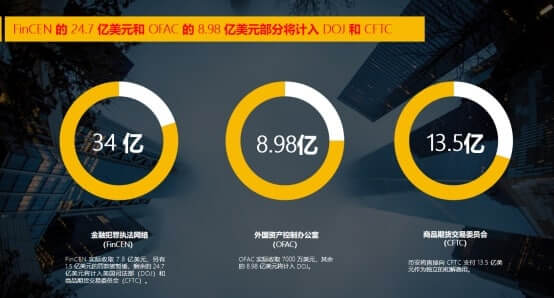

On November 11, Binance immediately issued an announcement stating that it had cooperated with美国Department of Justice (DOJ), Commodity Futures Trading Commission (CTFC), Foreign资产Office of Control (OFAC) and金融The Criminal Enforcement Network (FinCEN) has reached a resolution in its investigation into historical registration, compliance and sanctions issues at Binance.

The plea agreement is identical to previously disclosed documents, with CZ admitting to violating thebankConfidentiality Act, the International Emergency Economic Powers Act, and the Commodity Exchange Act to engage in unlicensed transfers, conspiracy charges, and prohibited transactions, including the provision of funds to designated terrorist organizations such as Hamas and Al Qaeda, violations of美国CorrectIran和Russiarelated to national sanctionsliquiditychannels and illegally provide transaction services to U.S. citizens.

Finally, Binance announced to the four major U.S.SupervisionInstitutions paid approximately 43.68 billion美元The payment ended this complicated and lengthy dispute with the power of money.

Binance compensation settlement plan, source: public information

Binance compensation settlement plan, source: public information

Looking back on the entire incident, this move by the United StatesSupervisionThe authorities were clearly prepared.

Judging from the investigation events, the investigation began as early as 2018. After nearly five years of extensive evidence collection and investigation, the data available for evidence is obviously sufficient. The choice to break out at this time may be related to the uncertainty caused by the continuous wars overseas. A more obvious example is that the funds of the Hamas terrorist organization mentioned in the plea agreement are exactly what the U.S. official said in recent months. The direction of a tough crackdown was clearly stated in several public meetings.From a political perspective, Binance’s previous violations only focused on the flow of money, but now they involve more aspects of national security and anti-money laundering. This is a red line that the US authorities cannot tolerate, and it is also the main trigger for the current outbreak of reconciliation.

It is precisely because these two areas are involved that unlike personal freedom in previous civil litigation, such as the defendant publicly speaking or even rebutting on the X platform, the intervention of the Ministry of Justice this time directly escalated the situation to more than one level. The entry of the Ministry of Justice represents personal control and psychological pressure. Bloomberg has reported that Zhao Changpeng originally faced up to 10 years in prison, but according to the plea agreement, the sentence is expected to be no more than 18 months.

The choice at this moment was obvious, whether to sign the plea agreement or not. It can also be seen from the final settlement plan that due to the power of enforcement, more than halffineThe amount can be collected by the Ministry of Justice, and the introduction of pressure by the Ministry of Justice has a significant effect. In the subsequent official speeches of the United States, the Department of Commerce and the Ministry of Finance both emphasized that Binance's violation of anti-money laundering AML does not endanger national security.

After CZ issued an open letter to bid farewell, Richard Teng, Binance’s former global regional market director, announced that he would take over as CEO and officially become Binance’s No. 1 position. According to the plea agreement, he is responsible for implementing a series of strict conditions proposed by the U.S. authorities in the plea agreement. If violated, he will be fined another 1.5 million.美元Offine.

At this point, the historical reconciliation between Binance and the United States has finally come to an end, but for Binance and the industry, the real test has just begun.

Binance enters the 2.0 era

From the perspective of Binance management, the founder, who was the soul of the company, resigned, and the newly appointed Richard Teng was appointed at the critical moment.ExchangeStability of faucet positioning still poses challenges. Not to mention the name CZ, for the industry itself, it is an absolute industry leader. On the X platform, CZ has as many as 850 million fans.

“When we think of Binance, we think of CZ,” said Aidan Larkin, CEO of Asset Reality. Within Binance, many employees also expressed that they were caught off guard by CZ’s resignation. Yesha Yadav, a professor of law at Vanderbilt University, directly questioned the future of Binance, believing that "it remains to be seen whether Binance 2.0, which lacks innovation, can attract the dominant trading volume in history."

But on the other hand, Binance has already taken control of this situation.

Although CZ has resigned from his position, his shareholding will not change, so he still has control over the company's major decisions to a certain extent. This is similar to BitMEX’s Arthur Hayes, who was also imprisoned,fineAfter exiting position 1, he returned to BitMEX as a consultant to participate in daily operations.

Richard Teng's appointment had actually been rumored as early as June this year.SingaporeSecuritiesMarketplaces(SGX) ChiefSupervisionofficer, and has since worked in Abu Dhabi Global MarketFinancial ServicesSupervisionHe has been the head of the Bureau for 6 years and has gained fruitful experience in compliance. He was promoted 2 times 4 years and 5 months after joining Binance. This time he was successfully promoted to the No. 1 position, which was also a result that CZ and Binance had expected. .

A person who has worked with Richard said, "The original intention of him being selected was to help Binance build a house on the existing foundation. He has first-hand experience in everything Binance needs to do next." CZ and He Yi have expressed their satisfaction with Richard Teng’s work ability more than once in public. He Yi even said bluntly in an interview, “I think he is an experienced professional manager. Since he joined Binance, his The range is constantly expanding and we all like and appreciate Richard.”

Just being recognized as an arm is still far from the decision-making of position 1. It is not difficult to achieve compliance through one's own professionalism, but more importantly, how to promote Binance's revenue generation and maintenance of market share, after all, it has been previouslySupervisionOver the past year, Binance has been CoinbaseIt has been overtaken by domestic compliant US companies such as Robinhood and lost most of its US market share.

“Binance is not a necessity for institutions. Institutions will choose toSupervisionEntities for trading, whether it is CME Group or other entities, the trading vehicles are very selective,” Rosenblatt Securities Senior ResearchAnalystAndrew Bond said that becauseillegal activitiesBeing restricted, Binance’s market share is likely to decrease. "If you engage inillegal activities, why choose to trade on Binance when all your activities are monitored?

But for partners who know the situation, CZ's escape seems to be the best outcome.

“I’m not worried about the future of Binance,” one person said using theExchangeOfCryptoThe person in charge of the market maker said. “The DOJ penalties and CZ’s ouster were almost entirely foreseeable, and I would have expected the outcome to be more difficult to predict, e.g.fineAdd a zero, after all, the United States has the ability to hunt down all executives and jail them. "From this point of view, CZ can have a nice holiday and is out of trouble after all," he added.

Another market maker leader also believes that the absence of CZ "may be a good thing for the company itself" because it "forces the company to grow and bring new ideas, and try them without absolute parental supervision."

The market performance is also consistent with the performance of public opinion. After the judgment was completed, the industry’s highest voice was that Binance’s compensation represented a staged victory for the industry, but the market’s heel vote was still obvious.

BNB price trend within 7 days, source: Binance

BNB price trend within 7 days, source: Binance

According to data from data provider Nansen, affected by the security of user funds, 24-hour BinanceExchangeThe net outflow exceeded US$6.5 million. Despite this, as the leader, Binance’s value strength cannot be underestimated. In contrast, a year ago competitorsExchangeFTX At the time of the collapse, capital outflows amounted to $60 billion. This can also be seen from the trend of the platform currency BNB, although affected by this newsFall14.5%, but has since risen again and is now at $236.69, down only 7% in 4.33 days.

The tipping point for industry compliance

From an industry perspective, this settlement will cause market turmoil in the short term, but the benefits will be more prominent in the long term. Many industry insiders believe that after the lawsuit against Binance is completed, compliance will enter a new stage, which will also lay the foundation for the entry of compliance agencies in the future.BitcoinSpotETFSignificant. reflect reality, not onlySECCommissioner Hester Peirce recently made another decision:SECNo reason to block spotETF", BlackRock also began to contact the SEC to discuss the details of the ETF.

The adoption of spot ETFs has become a matter of time, butSupervisionThe reality of compliance may not be as beautiful as imagined.

From the perspective of Binance, although Binance has reached a settlement with the United States, the lawsuit with the SEC has not come to an end. Industry sources say the SEC’s charges, which allege that Binance is an unregistered securities, are critical to Binance’s business.Exchange, and commingled billions of dollars in client cash with an independent trading firm owned by CZ. If the SEC wins the case, Binance will be required to recognize those trading on its platformCryptoare securities, which will increase significantlySupervisioncost.

And just recently, the SEC once againProsecute Kraken, accuses the world’s largestCryptoExchangeOne of them is in the futureSupervisionIllegal as securities when registered as an institutionExchangeoperations, and commingling customer funds, this accusation is actually consistent with Binance’s previousCoinbasesame.

Gurbir Grewal, director of the SEC's Division of Enforcement, said in a statement: "We charge Creak Violation of securities laws, frominvestmentAmong them, hundreds of millions of dollars were illegally obtained through commercial means. This decision created a conflict of interest in its business model, making itinvestmentInvestors’ funds are at risk.”

According to the SEC complaint, theExchangeAt times held more than $330 billion worth of property belonging to clientsCrypto. quoted Creak Auditors conducted research in 2023 that the company had record-keeping issues that resulted in "material errors" in financial statements regarding user funds, including escrow accounts, between 2020 and 2021.bankAccounts at the bank holding client funds were occasionally used to pay operating expenses due to this "internal control deficiency".

Prior to this, Kraken had settled with the SEC several times. The most recent one was in February this year, when Kraken terminated its license for U.S. customers.Cryptostaking-as-a-service platform and paid $3000 million to settle SEC charges that it offered unregistered securities.

Repeated lawsuits and settlements have become a tug-of-war.CoinbaseIt also took the opportunity to once again accuse the SEC of delaying its petition for new encryption rules. But in terms of seriousness, the nature of the SEC’s civil lawsuit is destined to continue the battle between the exchange and it for many years.

He Yi’s speech in the WeChat group after Binance’s settlement, source: public community

He Yi’s speech in the WeChat group after Binance’s settlement, source: public community

From this point of view,SupervisionThe party and the encryption party seem to be on opposite sides,SupervisionFang believes that the exchange's role of custody and clearing at the same time is both an athlete and a referee, while the crypto side believes that it is too harsh.SupervisionNot applicable to emerging industries. In the United States, where factional struggles are becoming increasingly fierce, questions surrounding fundingflowThe encryption stance is more complicated, and the battle between Republicans and Democrats will further affect the development of the industry.

But for both Binance and the industry, the direction of compliance is already very clear. CZ did not have to sacrifice its life and blood, and spent money to buy freedom; Binance, which left CZ, also ushered in a bumpy new life, but as long as it moved towards compliance and ended the lawsuit, Binance shed the burden of history, although it still There are lawsuits left over, but you can attack and defend later. Not only do you still have the opportunity to return to the United States to seize the compliance market, but you can also continue to expand your influence to marginal areas. No matter what happens, you still have the ability to defend your success; and the development of the industry is facing the challenges. come predictablyBitcoinAfter spot ETF, it will also enter the next stage.

At least for now, everyone, retail investors, institutions and practitioners, has a bright future.

references:

FT:Binance crypto dominance under threat after loss of founder Changpeng Zhao;

Coindesk: 'They're Playing a Game': What New Yorkers Think of the SEC's War Against Crypto